The Evolution and Impact of Decentralized Crypto Wallets: Empowering Users Beyond Traditional Banking

In the ever-evolving world of cryptocurrency, a critical component that allows users to securely store and manage their digital assets is the crypto wallet MetaMask extension. These wallets have advanced significantly over the years, adapting to new technologies, regulations, and user demands. While traditional wallets are often tied to physical currencies and centralized banking systems, crypto wallets provide an entirely different set of capabilities, especially with the rise of decentralized finance (DeFi).

What is a Crypto Wallet?

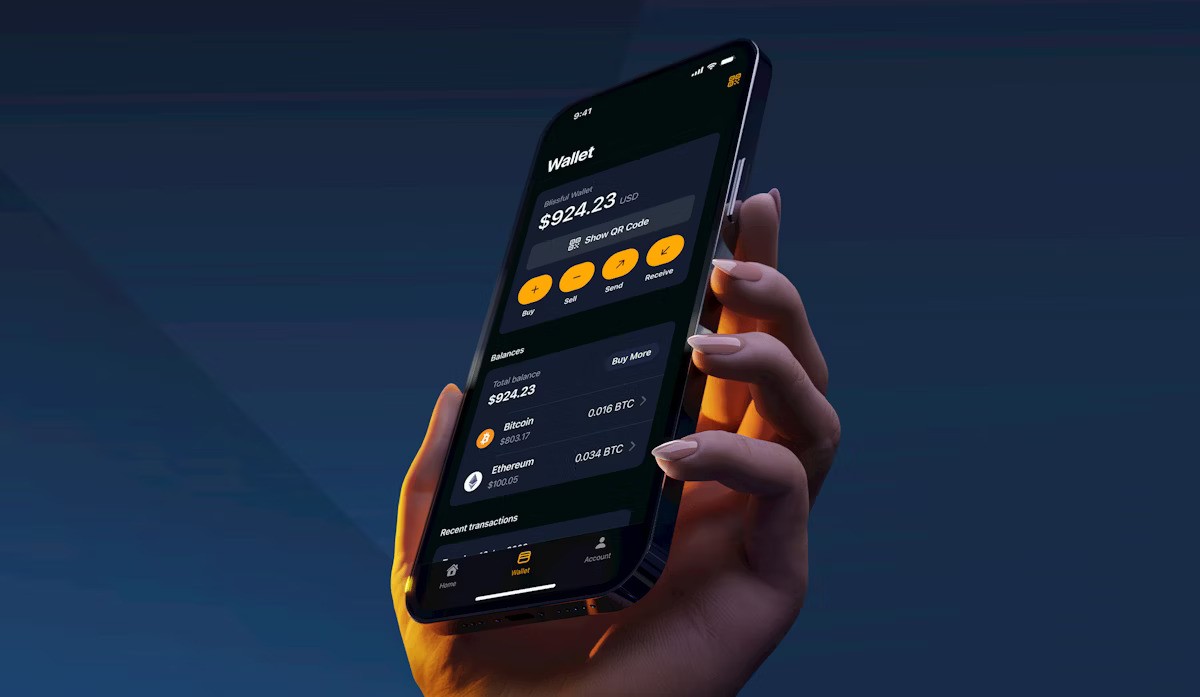

At its core, a crypto wallet is a tool that allows users to interact with blockchain networks, such as Bitcoin or Ethereum, by securely storing private keys needed to access their cryptocurrency holdings. These wallets can be either software-based (online, desktop, or mobile apps) or hardware-based (physical devices that store keys offline for added security).

However, the real magic of crypto wallets lies in the fact that they grant users complete ownership and control over their assets. Unlike traditional banking systems, where banks manage users’ funds and transactions, crypto wallets operate in a decentralized manner, meaning that users themselves hold the keys to their funds.

The Unique Advantage of Decentralized Crypto Wallets

One of the most compelling aspects of crypto wallets, especially decentralized ones, is that they are not dependent on any central authority, such as a bank or government. This decentralization offers several key advantages:

- Financial Sovereignty: Decentralized wallets give users complete control over their funds. There is no need to rely on intermediaries, such as banks or payment processors, to access or transfer funds. This is particularly valuable for individuals in regions with limited access to traditional banking or for those who prefer to maintain financial privacy and independence.

- Security and Privacy: Many users are drawn to crypto wallets due to their ability to offer higher levels of security and privacy compared to traditional banking systems. Private keys, which are necessary to access and transfer cryptocurrency, are stored securely within the wallet, and these keys are never shared with third parties. Additionally, decentralized wallets often offer encryption, multi-signature authentication, and other advanced security features to protect users’ funds from theft or hacks.

- No Geographical Boundaries: With decentralized crypto wallets, users can send and receive funds globally without restrictions. There are no international borders or limitations typically associated with traditional banking systems, making it easier for people to conduct business, invest, or participate in global economies.

- Integration with Decentralized Finance (DeFi): Crypto wallets have become the gateway to the rapidly growing world of DeFi. Users can leverage their wallets to participate in lending, borrowing, staking, and yield farming without relying on centralized intermediaries. These decentralized platforms are built on smart contracts and enable users to engage in financial activities in a more autonomous and peer-to-peer manner.

- Ownership and Control of NFTs: As the popularity of non-fungible tokens (NFTs) skyrockets, crypto wallets provide a secure and decentralized way to store and manage these digital assets. Wallets allow users to interact with NFT marketplaces, verify ownership, and engage in buying, selling, or trading NFTs with ease.

Types of Crypto Wallets: Finding the Right Fit

Crypto wallets come in different forms, and choosing the right type depends on the user’s needs, experience, and security preferences. The main types of crypto wallets include:

- Hot Wallets: These are software-based wallets that are always connected to the internet, making them convenient for quick access and transactions. Examples include mobile apps like MetaMask and Trust Wallet. While hot wallets are user-friendly, they are considered less secure than cold wallets due to their constant connection to the internet, which makes them more susceptible to hacking.

- Cold Wallets: Cold wallets, such as hardware wallets (Ledger, Trezor), store private keys offline, making them significantly more secure than hot wallets. They are perfect for users who plan to hold large amounts of cryptocurrency for the long term. Since cold wallets are not connected to the internet, they are less vulnerable to online attacks.

- Multi-signature Wallets: These wallets require multiple private keys to authorize a transaction, adding an extra layer of security. Multi-sig wallets are commonly used by businesses or groups who want to ensure that more than one person is involved in decision-making and approvals for financial transactions.

- Web Wallets: Accessible via web browsers, these wallets provide a convenient and often free way to store cryptocurrencies. While they offer ease of use, the user must trust the wallet provider to keep their funds secure. Web wallets are typically less secure than hardware wallets, but they’re a good option for beginners.

Challenges and Future of Crypto Wallets

Despite the benefits, the adoption and use of crypto wallets face several challenges. For one, users must be responsible for safeguarding their private keys. If a key is lost or stolen, access to funds can be permanently lost. Additionally, the complexity of certain wallets can be intimidating for new users, and the volatile nature of cryptocurrencies means that users must stay informed about security best practices to protect their assets.